Financial margin formula

Further the contribution margin formula provides results that help you in taking short-term decisions. During the financial year 2018 Firm ABC has sold mobile phones of INR 200000 and followings are the variable cost for the firm.

How To Calculate Gross Profit Margin Profit Profitable Business Cost Of Goods Sold

The uses of the financial leverage equation are as follows.

. Enroll in The Premium Package. These ratios represent the financial viability of the company in various terms. Company XYZ operates at a 30 net margin meaning that 030 of every dollar earned in revenue ends up as net profit.

First Name Email Sign Me Up. Which is authorised by the Financial Conduct Authority under the Electronic Money. Gross Margin 38.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. Just like gross margin net profit margin enables you to discover business profitability. Let us see the EBITDA Margin calculation The EBITDA Margin Calculation EBITDA Margin is an operating profitability ratio that helps all stakeholders of the company get a clear picture of the companys operating profitability and cash flow position.

Total Variable Cost is calculated as. Learn Financial Statement Modeling DCF MA LBO and Comps. Read more of all.

Contribution margin calculation is one of the important methods to evaluate manage and plan your companys profitability. Like other profitability ratios Gross Profit Margin Pre-tax Profit. ABC is currently achieving a 65 percent gross profit in her furniture business.

Now calculate the mean of the population. This formula shows the total number of sales above the breakeven point. The formula to calculate gross profit margin as a percentage is.

PG HA Net profit margin on sales. Total Variable Cost INR 50000200004000030000. Operating margin is a financial metric used to measure the profitability of a business.

Operating Profit Margin is one of the measures to calculate the profitability of a company. In that case we will be able to interpret whether the net margin of Uno Company is. Net profit margin.

Financial analyst generally and esp. Check what is the gross margin formula good gross profit margin net profit margin with example. Firstly figure out the net sales which are usually the first line item in the income statement of a company.

Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65. Christie reports the follow numbers on her financial statements. Thus the level of production along with the contribution margin are essential factors in developing your business.

But it does not account for important financial considerations like administration and personnel costs which are included in the operating margin calculation. The formula for Gross Margin can be calculated by using the following steps. 1800 700 5576.

Below is the snapshot of Colgates Income Statement from 2007 to 2015. The same training program used at top investment banks. According to our formula Christies operating margin 36.

For the year ended. It helps to know the financial risks of the company. Learn financial statement modeling DCF MA LBO Comps and Excel shortcuts.

It helps in taxation by reducing the net cost of borrowing as interest expense is tax-deductible. Using the second method the calculation of EBIT margin formula can be done using the following steps. Financial Leverage Formula works on the saying that the higher the ratio of debt to equity greater the return for the equity shareholders because with the higher proportion of debt in the capital structure of the company more financing decisions are taken through debt financing and lesser weighted is given to equity funding which results in.

Gross Profit Margin Total Revenue Cost of Goods SoldTotal Revenue x 100. The margin of safety formula is calculated by subtracting the break-even sales from the budgeted or projected sales. Using the net margin formula we divide the 30000 net profit by the 100000 total revenue to obtain our net margin percentage.

Financial leverage also helps in making major decisions for a company. The formula for calculating the EBITDA margin is as follows. It is calculated by.

Qualification discussing various investment banking and corporate roles ie. Remay Villaester May 121021. This means that 64 cents on every dollar of sales is used to pay for variable costs.

Firstly one can capture the net income from the income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and expenses over time in order to determine. Explanation of Financial Leverage Formula. The margin of safety is a financial ratio that measures the amount of sales that exceed the.

Suppose we compare this net margin with the net margin of companies under a similar industry. Cost of Goods Sold. In other words the total number of sales dollars.

PG HA Operating Margin EBIT Net sales Measures profitability independently of an enterprises financing and tax positions Benchmark. From this example we find that the net margin of Uno Company is 1225. Financial management corporate finance investment banking securities analysis.

Follow the below steps. Net sales all operating expenses. Examples of Contribution Margin Formula With Excel Template.

Using the formula of net margin we get Net Margin Formula Net Profit Net Sales 100. Firstly gather the statistical observations to form a data set called the population. Definition Formula and Calculation.

A margin of safety or safety margin is the difference between the intrinsic value of a stock and its market price. Margin of Safety Formula. The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales.

EBITDA Margin EBITDA Revenue. Margin of Safety MOS 1 Current Share Price Intrinsic Value For instance lets say that a companys shares are trading at 10 but an investor has estimated the intrinsic value at 8. EBI Earnings Before Interest Expense.

Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts. Financial leverage is used in corporate capital structuring. Break-even point is a no-profit no-loss scenario.

Operating Profit Margin formula Operating Profit Net Sales 100. In break-even analysis from the discipline of accounting margin of safety is how much output or sales level can fall before a business reaches its break-even point. See Financial modeling Accounting.

Gross profit margin on sales Net sales COGS Gross margin Net sales Captures the relation between sales generated and manufacturing or merchandising costs Benchmark. The operating margin shows what percentage of revenue is left over after paying for costs of goods sold and operating expenses but before interest and taxes are deducted. Everything You Need To Master Financial Modeling.

Gross Margin Formula Example 2. It shows the financial health of your business and how good you are at keeping your expenses to a minimum. Other important financial metrics about a company should also be considered before investing.

Next figure out the cost of goods sold or cost of sales from the income statement.

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

Contribution Margin Contribution Margin Financial Analysis Learn Accounting

Entrepreneurship Archives Napkin Finance Financial Literacy Lessons Finance Investing Small Business Planner

2020 Ch 7 Ins Ex P2 Cvp Be And Target Profit Managerial Accounting Target Profit

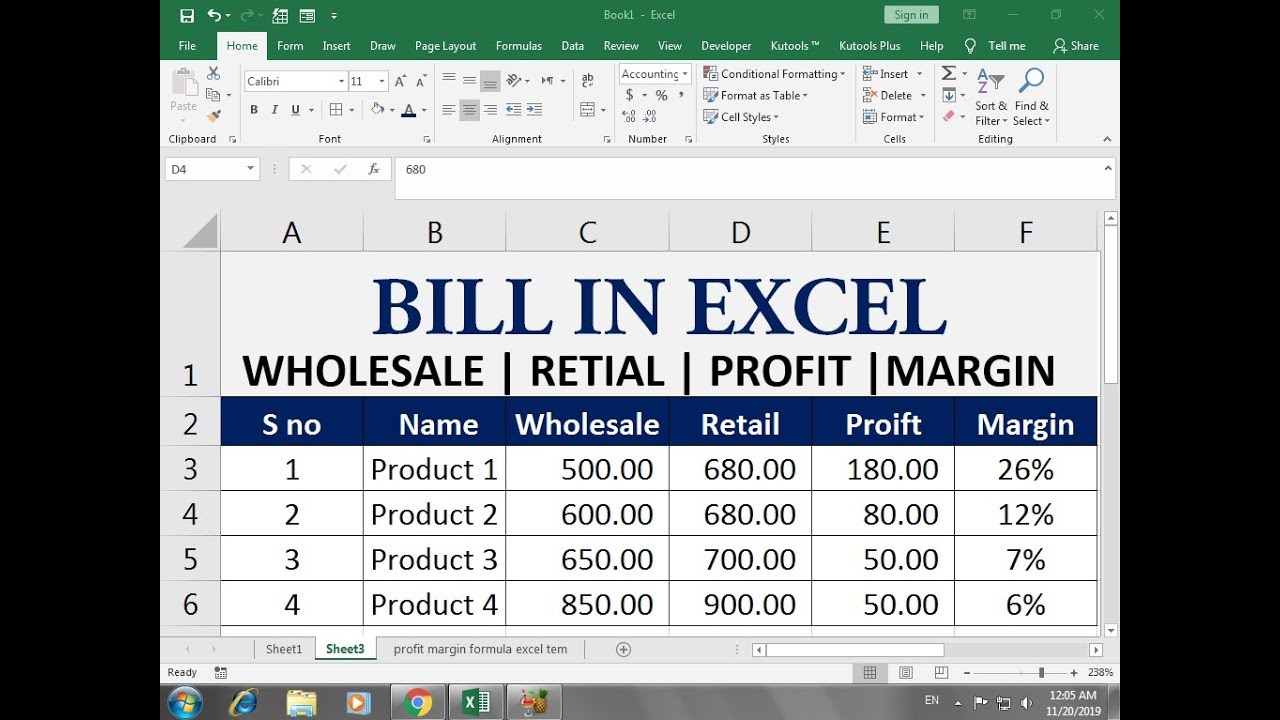

Excel Sales Bonus And Profit Margin Calculation By Learning Center Learning Centers Learning Free Learning

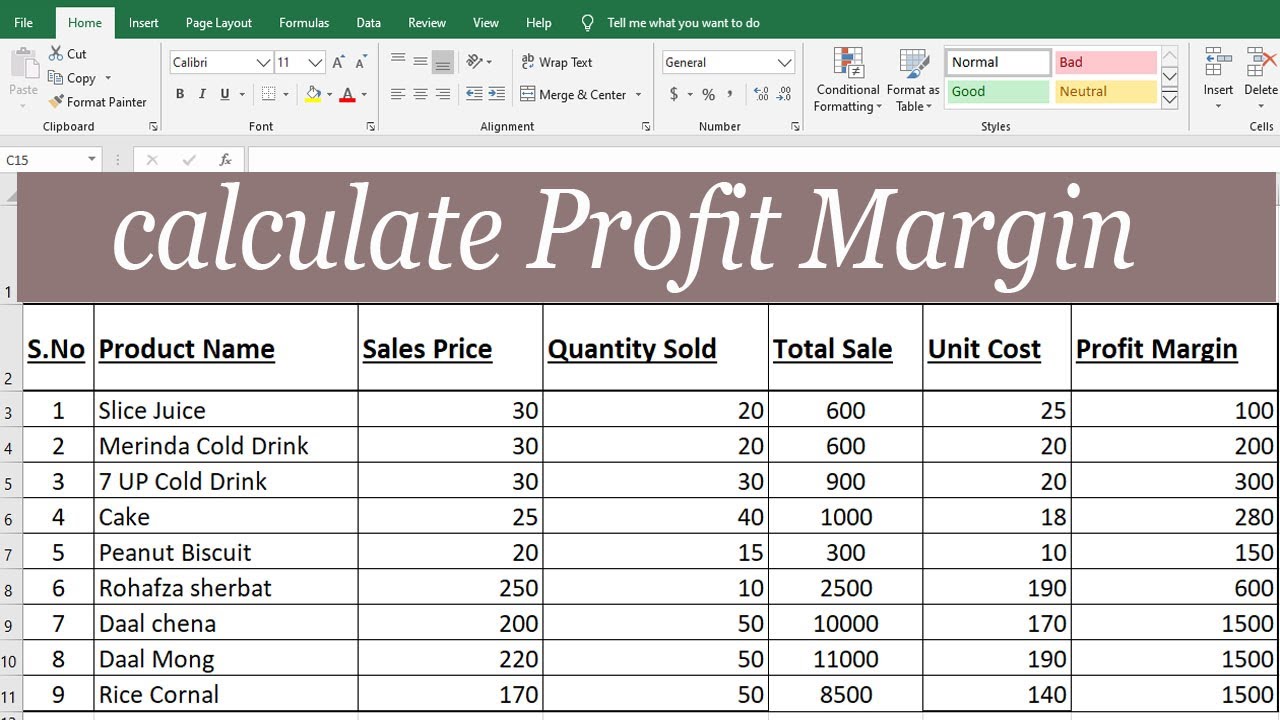

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Contribution Margin And Break Even Points Managerial Accounting Tutorial 13 Cost Accounting Contribution Margin Accounting Notes

Formula For Net Profit Margin In 2022 Net Profit Net Income Profit

Margin Vs Markup Chart How To Calculate Margin And Markup Accounting Bookkeeping Business Business Analysis

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software